Key takeaways An LLC has access to some small business loans that are designed specifically for funding a variety of business expenses. LLC loans can be used for many things, including working capital, covering start-up costs, equipment or inventory purchases, advertising and marketing and even commercial real estate. Signing a…

A complicated U.S. economy. Stubborn inflation and a jobless boom. Unprecedented conflict with the president. Personnel changes, and a new Fed chair. Federal Reserve officials are no stranger to difficult economic moments, but the upcoming year could prove to be more dramatic than usual for the U.S. central bank —…

Westend61/GettyImages; Illustration by Hunter Newton/Bankrate Key takeaways FHA 203(k) loans provide funding to finance both a home’s purchase and the cost of repairing it. This type of loan, which you can obtain from an FHA-approved lender, is reserved for borrowers who intend to live in the home, not house-flippers or…

Key takeaways The value of the child tax credit in 2025 (for tax returns filed in 2026) is $2,200, up from $2,000 in 2024. Going forward, the value of the child tax credit will be adjusted for inflation each year. There are income limits: The child tax credit starts to…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

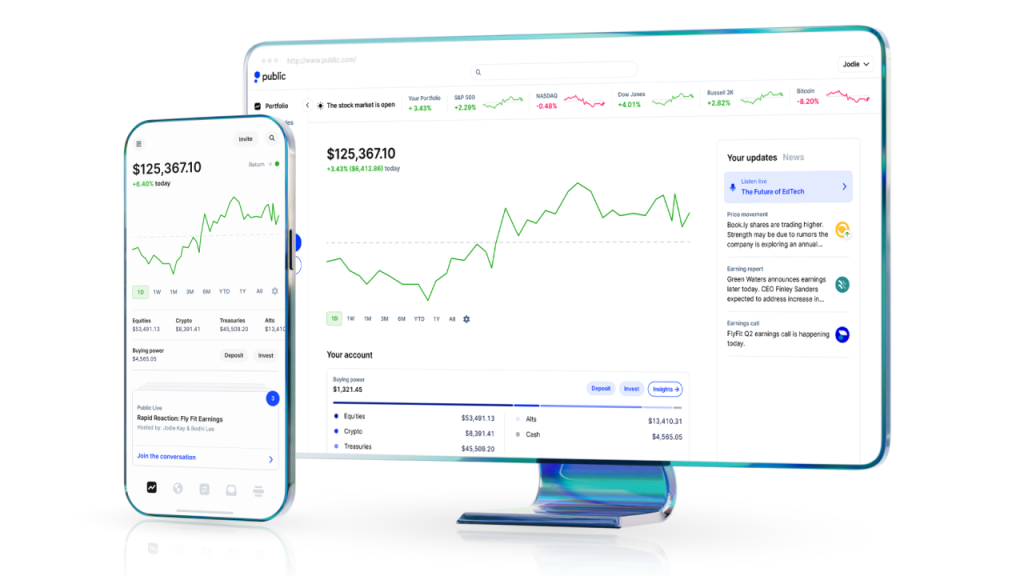

Public is an investing platform that offers a solid trading experience, free trades on stocks and ETFs, easy access to bonds — and options traders will enjoy getting money back on their trades through Public’s rebate program. Other key features include: Fractional shares, so you…

Dept Managmnt

How Long Does Collections Stay on My Credit Report? Also keep in mind that just because a lender or agency loses the ability…

Banking

These entrepreneurs, traders and investors are making an outsized impact in fintech, crypto and traditional financial services.By Jeff Kauflin, Hank Tucker and Nina…

Credit Cards

All News

ImagePixel/Getty Images; Illustration by Issiah Davis/Bankrate Key takeaways The right credit card program for you depends on how you spend and how you prefer to redeem rewards. Top rewards programs offer flexible earning structures and valuable redemption options, including points transfers. Many also include extra perks like limited-time offers, dining…

Image by GettyImages; Illustration by Bankrate Key takeaways Unsecured loans are debt products that do not require collateral but may come with higher interest rates and stricter credit requirements. There are various unsecured loans, including personal loans, student loans, and credit cards. When determining eligibility for an unsecured loan, lenders…

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that…

When your home experiences damage from a covered disaster, your insurer uses one of two methods for determining the payout for damages and lost belongings. Actual cash value, or ACV, takes depreciation into account, and pays out based on what your belongings are worth now, in their depreciated state. Replacement…

In South Carolina, a lead foot can come with a lasting price tag. A simple speeding ticket might seem like no big deal at first — but even a minor violation could cost you more than you’d expect. In towns like Summerville, for example, fines start around $75 for going…

Did the holiday season leave your finances in the red? A temporary setback doesn’t have to become a permanent burden. This is where a financial reset can help. A 2026 financial reset is a strategic plan designed to help you recover from holiday overspending and realign your budget for the…

10’000 Hours/Getty Images New Jersey drivers pay an average cost of $3,254 for full coverage car insurance and $1,413 for minimum coverage as of November 2025. These potential costs may put an undue financial burden on some New Jersey residents who have limited budgetary resources. For those individuals, there may…

There has been a lot of buzz in the news recently about President Trump’s proposed 10% cap on credit card interest rates and what it could mean for people struggling with high balances. While this is still a proposal, the bigger question for consumers is simple: If your interest rates…

Key takeaways Savings accounts are deposit accounts available at banks and credit unions. They allow you to keep your money safe while it earns interest. Online banks tend to offer the highest interest rates for savings accounts. You can withdraw your money from a savings account at any time, though…

Prioritizing debt in January starts with reviewing all balances, understanding monthly expenses, and redirecting available cash toward debt repayment so holiday balances do not continue to grow. With 37% of Americans accumulating an average of $1,223 in holiday debt, according to LendingTree, many households begin the year looking for a financial reset. A…

Editor's Pick