Key takeaways An LLC has access to some small business loans that are designed specifically for funding a variety of business expenses. LLC loans can be used for many things, including working capital, covering start-up costs, equipment or inventory purchases, advertising and marketing and even commercial real estate. Signing a…

A complicated U.S. economy. Stubborn inflation and a jobless boom. Unprecedented conflict with the president. Personnel changes, and a new Fed chair. Federal Reserve officials are no stranger to difficult economic moments, but the upcoming year could prove to be more dramatic than usual for the U.S. central bank —…

Westend61/GettyImages; Illustration by Hunter Newton/Bankrate Key takeaways FHA 203(k) loans provide funding to finance both a home’s purchase and the cost of repairing it. This type of loan, which you can obtain from an FHA-approved lender, is reserved for borrowers who intend to live in the home, not house-flippers or…

Key takeaways The value of the child tax credit in 2025 (for tax returns filed in 2026) is $2,200, up from $2,000 in 2024. Going forward, the value of the child tax credit will be adjusted for inflation each year. There are income limits: The child tax credit starts to…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

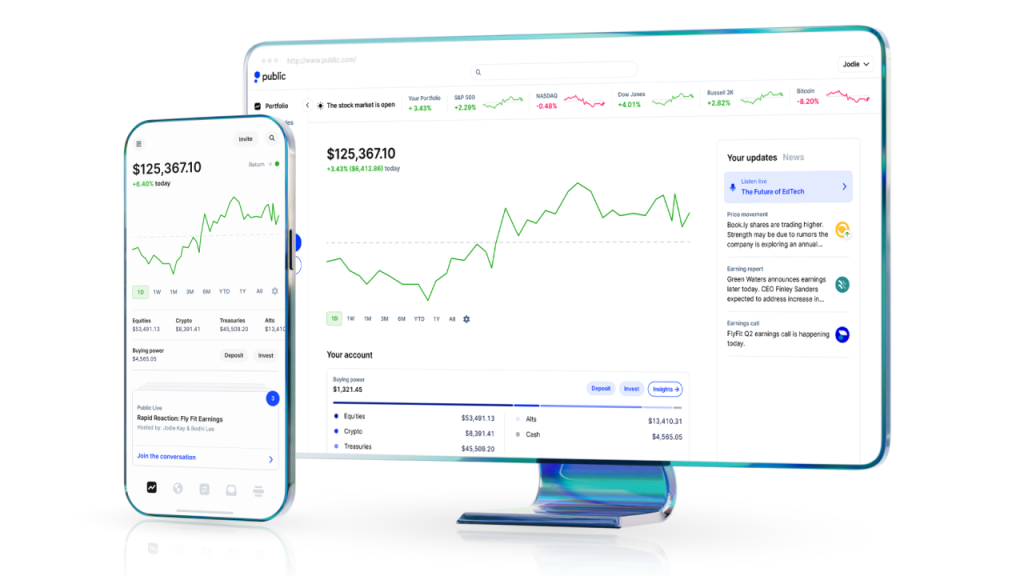

Public is an investing platform that offers a solid trading experience, free trades on stocks and ETFs, easy access to bonds — and options traders will enjoy getting money back on their trades through Public’s rebate program. Other key features include: Fractional shares, so you…

Dept Managmnt

How Long Does Collections Stay on My Credit Report? Also keep in mind that just because a lender or agency loses the ability…

Banking

These entrepreneurs, traders and investors are making an outsized impact in fintech, crypto and traditional financial services.By Jeff Kauflin, Hank Tucker and Nina…

Credit Cards

All News

Key takeaways Several airline credit cards offer discounts on tickets for your traveling companions when you meet certain criteria. Available discounts range from flat-rate fares to fully comped tickets (minus taxes and fees). Take note of your card’s eligibility requirements so you can maximize your companion discount benefits. If you…

When people hear the phrase debt management program, there’s often confusion, hesitation, or even fear attached to it. As a credit counselor, I see this every day. Many individuals know they’re overwhelmed by debt, but they don’t fully understand what their options are or what credit counseling actually does. I…

Trump Keeps Sharing Proposals To Fix The Housing Market. Experts Aren’t Confident They’ll Help

President Donald Trump offered two new proposals this week aimed at the stubbornly complex issue of home affordability. Trump on Wednesday said he would move to ban institutional buyers from the housing market. Then on Thursday, he proposed a mortgage bond program aimed at lowering mortgage rates. Will either achieve…

A retirement budget compares expected income with planned expenses to see whether spending fits within available income. This process begins by listing income sources and savings and estimating how much they can provide each year. To show how a retirement budget works, let’s break down an example of a retirement…

Luxury cars come with a higher price tag, but many drivers don’t realize that the same features that make these cars feel special can also bump up their insurance costs. Leather seats, powerful engines, and high-tech safety features are all expensive to repair or replace after an accident, and insurers…

Getting a DUI in Michigan can have lasting and costly consequences. Beyond fines and legal trouble, drivers will see their insurance rates increase when their policies renew — some drivers may even get dropped by their carrier. Average rate data from Quadrant Information Services shows that Michigan car insurance rates…

F.J. Jimenez/ Getty Images; Illustration by Austin Courregé/Bankrate Virginia drivers used to be able to circumvent minimum insurance coverage by paying a $500 uninsured motor vehicle (UMV) fee. However, this is no longer the case. Drivers are now mandated by law to carry a certain amount of bodily injury liability…

Cherdchanok Treevanchai/Getty Images Key takeaways Home insurance typically covers foundation issues caused by covered perils, such as fire and severe weather events like hurricanes and tornadoes. Exclusions to coverage may include wear and tear, neglect, faulty construction and settling or expansion of soil. It is important for homeowners to maintain…

Andriy Onufriyenko/ Getty Images; Illustration by Austin Courregé/Bankrate Key takeaways Credit card networks and issuers perform two distinct roles, though both can issue credit cards. Credit card issuers are responsible for card details, rates, fees and perks. Credit card networks may play a role in available card…

Bond prices have been volatile in recent years as the Federal Reserve hiked interest rates to combat high inflation, but with rate cuts paused for now, investors may still be able to take advantage of attractive yields in short-term bonds. Here’s what you should know about short-term bond funds and…

Editor's Pick